BEIJING/HONG KONG, Jan. 28 – Many predicted catastrophe for China’s faltering economy when U.S. President Donald Trump took office a year ago with a “America First” agenda. However, Beijing has warmed icy relations with other trading partners to report a record trade surplus.

According to commentators, China has shifted its attention to building relationships with important allies, such as Canada and India, while Trump’s actions have damaged ties with traditional U.S. friends.

As a result, the trade surplus of the second-largest economy in the world reached a record $1.2 trillion in 2025, monthly foreign exchange inflows reached $100 billion, the highest level ever, and the use of China’s currency, the yuan, increased globally.

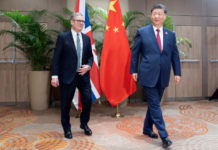

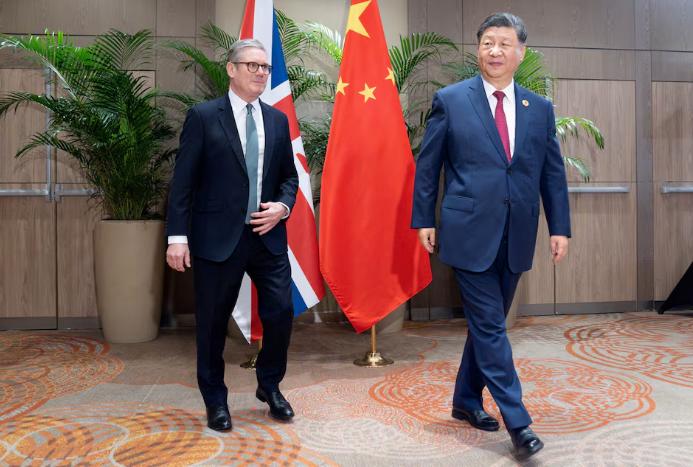

Beijing is anticipated to increase its worldwide political and economic influence when British Prime Minister Keir Starmer arrives in China on Wednesday night in an attempt to revive lately frayed business relations, according to analysts and experts.

According to Boston College economics professor Aleksandar Tomic, China is becoming a “steady partner” for many nations thanks to its $20 trillion GDP and $45 trillion in stock and bond markets.

Derrick Irwin, co-head of intrinsic emerging markets equity at Allspring Global Investments, stated, “I think China has done a good job and rightly so to position itself as the reliable and stable trade partner.”In essence, they said, “Look, you have a huge trading partner in the United States that has become a little more uncertain.” We are able to provide certainty and predictability. And that seems really reasonable to me.”

Following Canadian Prime Minister Mark Carney’s visit to Beijing earlier this month—the first Canadian prime minister to do so since 2017—Starmer’s four-day trip to China will be the first by a British prime minister since 2018.

The two countries struck an economic agreement to remove trade restrictions and establish a new strategic partnership during Carney’s visit. “A more predictable and reliable partner” is how Carney characterized China.

However, China is not the only country considering new trade agreements to reduce US risk. A long-awaited trade agreement between India and the EU was reached on Tuesday. It will lower tariffs on the majority of commodities, increasing two-way trade and possibly doubling European exports to the South Asian nation by 2032.

CHINA ECONOMY RESILIENT

Although the two biggest economies in the world have been embroiled in geopolitical conflicts for a few years, tensions on a number of fronts, including trade and technology, drastically increased once Trump returned to the White House in January 2025.

Beijing increased its exports to non-US markets and implemented assistance measures for its private businesses and markets while Trump hiked tariffs on China to over 100% in April before partially backtracking and agreeing to a temporary truce.

In 2025, Chinese exports to the United States decreased by 20%, but last year they increased by 25.8% to Africa, 7.4% to Latin America, 13.4% to Southeast Asia, and 8.4% to the European Union.

“Many countries previously have not been China-friendly are now kind of pivoting to China … because the United States is becoming a lot less predictable,” Tomic stated. “The more the U.S. gets difficult to deal with, the more it opens up for China.”

Despite the trade disputes with the United States, China’s economy has achieved the government’s goal of 5% growth in 2025 despite internal deflationary pressure brought on by low domestic demand and a protracted decline in the real estate industry.

China has taken a number of steps in recent months to encourage foreign investment, including expanding pilot programs in Beijing, Shanghai, and other areas and opening up new markets for services including telecoms, healthcare, and education.

According to bank settlement figures from its forex regulator, the nation reported the highest-ever monthly foreign exchange inflows of $100.1 billion in December. At $3.36 trillion, its official foreign exchange reserves reached a ten-year high.

With the Shanghai index rising 27% over the past year, outperforming U.S. stocks, market turnover reaching a record high, and the yuan’s global usage growing, its financial industry has recovered well from trade tensions.

According to bankers with knowledge of the situation, Beijing is also moving forward with its goal to increase the use of yuan globally as the dollar loses attraction to investors as a result of Trump’s unpredictable approach to trade and foreign diplomacy.

They noted that several of the major international banks are rushing to increase yuan liquidity in offshore hubs and build up systems for quicker yuan payment settlements in trade corridors between China and Southeast Asia, the Middle East, and Europe.A banker at a multinational bank with a presence in China stated, “We have witnessed quite a few cycles of China trying to internationalize yuan and then pulling back.” “This time it’s different … Trump policies are very conducive for boosting yuan usage.”

According to the most recent data from the PBOC and SAFE, more than half of China’s cross-border transactions are now settled in yuan, compared to almost none fifteen years ago, and over half of China’s offshore bank loans is now in renminbi.

CHINA CAUTION

However, several foreign policy experts warn against China’s new, more accommodative political and economic strategy.

Patricia Kim, a foreign policy fellow at the Brookings Institution in Washington, stated that despite the new trade agreements, mistrust of the United States does not translate into trust in Beijing for American allies and partners.

“Many of these countries harbour deep concerns about China’s approach to trade, its use of economic coercion, and unresolved maritime and historical disputes,” Kim said.In contrast to the aggressive rhetoric and actions of the Trump administration, China may currently seem more controlled or practical. However, Beijing’s real actions haven’t been particularly comforting.

Reporting by Liz Lee in Beijing, Samuel Shen in Shanghai and Sumeet Chatterjee in Hong Kong; Editing by Michael Perry